Travel insurance is an essential component of any travel plan, offering peace of mind and financial protection against unforeseen events that could disrupt your trip. In Dubai, a city renowned for its luxurious lifestyle and as a global travel hub, the significance of travel insurance cannot be overstated. Tawasul Insurance is dedicated to providing comprehensive travel insurance in Dubai solutions tailored to the unique needs of travelers in Dubai.

Understanding Travel Insurance

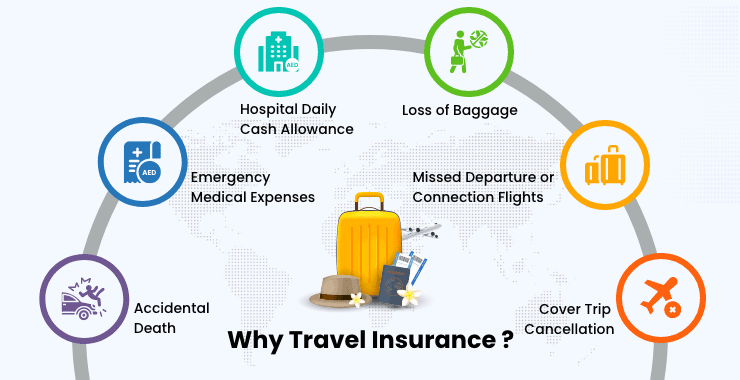

Travel insurance is designed to cover a variety of risks associated with travel, including medical emergencies, trip cancellations, lost luggage, flight delays, and more. For travelers in Dubai, having a robust travel insurance policy is particularly important due to the high cost of healthcare and the bustling nature of travel in and out of the city.

Why Travel Insurance is Essential in Dubai

- Medical Emergencies: Dubai boasts some of the best healthcare facilities in the world. However, medical treatment can be extremely expensive, especially for tourists. Travel insurance ensures that you are covered for medical emergencies, including hospitalization, doctor’s fees, and even medical evacuation if necessary.

- Trip Cancellations and Interruptions: Unexpected events such as illness, natural disasters, or political unrest can lead to trip cancellations or interruptions. Travel insurance protects your investment by covering the costs associated with these unforeseen changes, ensuring that you are not left out of pocket.

- Lost or Delayed Luggage: The inconvenience of lost or delayed luggage can severely impact your travel experience. Travel insurance provides compensation for essential items you may need to purchase and reimburses you for the lost luggage itself.

- Flight Delays and Cancellations: Flight delays and cancellations are common in busy travel hubs like Dubai. Travel insurance helps cover the costs of additional accommodation, meals, and transportation, reducing the stress and financial burden of such disruptions.

Key Features of Tawasul Insurance Travel Policies

At Tawasul Insurance, we understand the diverse needs of travelers. Our travel insurance policies are designed to offer comprehensive coverage and peace of mind. Here are some key features of our travel insurance plans:

- Extensive Medical Coverage: Our policies cover a wide range of medical expenses, including emergency medical treatment, hospitalization, surgery, and dental care. We also provide coverage for medical evacuation and repatriation.

- Trip Cancellation and Interruption: We offer coverage for trip cancellations and interruptions due to various reasons, including illness, accidents, and unforeseen events. This ensures that you can recover the costs of non-refundable trip expenses.

- Baggage and Personal Belongings: Our insurance plans cover the loss, theft, or damage of your baggage and personal belongings. We also provide compensation for delayed luggage, helping you manage the inconvenience.

- Travel Delay: In the event of a travel delay, our policies cover additional expenses such as accommodation and meals, ensuring that you are not financially burdened by unforeseen delays.

- Personal Liability: We offer coverage for personal liability, protecting you against legal expenses if you are held responsible for causing injury or damage to property while traveling.

- Adventure Sports Coverage: For thrill-seekers, our policies can include coverage for a range of adventure sports, ensuring that you are protected while engaging in high-risk activities.

Choosing the Right Travel Insurance Plan

Selecting the right travel insurance plan can be overwhelming given the myriad options available. Here are some tips to help you choose the best travel insurance policy for your needs:

- Assess Your Needs: Consider the nature of your trip and the risks involved. If you are traveling for adventure sports or on a business trip, your insurance needs may differ.

- Compare Coverage: Look at the coverage offered by different policies. Ensure that the policy covers medical expenses, trip cancellations, baggage loss, and other essential aspects.

- Check Exclusions: Be aware of what is not covered by the policy. Common exclusions include pre-existing medical conditions, certain adventure sports, and acts of terrorism.

- Read the Fine Print: Understand the terms and conditions of the policy, including claim procedures and documentation requirements.

- Consider the Cost: While it is important to find an affordable policy, ensure that it does not compromise on essential coverage. Balance cost with the comprehensiveness of the coverage.

Making a Claim with Tawasul Insurance

At Tawasul Insurance, we strive to make the claims process as smooth and hassle-free as possible. Here’s a step-by-step guide to making a claim:

- Notify Us Promptly: In the event of an incident, notify us as soon as possible. For medical emergencies, contact our emergency assistance team immediately.

- Collect Documentation: Gather all necessary documentation to support your claim. This may include medical reports, receipts, police reports (in case of theft), and proof of travel expenses.

- Submit Your Claim: Complete the claim form and submit it along with the supporting documentation. Ensure that all information is accurate and complete to avoid delays.

- Claim Assessment: Our claims team will assess your claim based on the provided documentation and policy terms. We aim to process claims efficiently and keep you informed throughout the process.

- Receive Compensation: Once your claim is approved, we will process the payment promptly. The compensation will be credited to your account or provided through other agreed means.

Why Choose Tawasul Insurance?

- Experience and Expertise: With years of experience in the insurance industry, Tawasul Insurance has the expertise to provide reliable and comprehensive travel insurance solutions.

- Customer-Centric Approach: We prioritize our customers’ needs and strive to offer personalized services. Our team is dedicated to providing support and guidance throughout your travel insurance journey.

- Wide Network of Partners: We have a broad network of healthcare providers, travel agencies, and other partners to ensure that you receive timely and efficient assistance when needed.

- Competitive Pricing: We offer competitive pricing without compromising on the quality of coverage. Our policies are designed to provide value for money and comprehensive protection.

- 24/7 Assistance: Our emergency assistance team is available 24/7 to provide support and assistance in case of emergencies, ensuring that you are never alone during a crisis.

You may also explore: Best Car Insurance in UAE

Conclusion

Travel insurance is an indispensable aspect of any travel plan, offering protection against a wide range of risks and ensuring peace of mind. In a vibrant and dynamic city like Dubai, having the right travel insurance is crucial to safeguard against unforeseen events that could disrupt your trip. Tawasul Insurance is committed to providing comprehensive travel insurance solutions tailored to the unique needs of travelers. With our extensive coverage, competitive pricing, and customer-centric approach, we are your trusted partner in ensuring a safe and enjoyable travel experience. Whether you are traveling for leisure, business, or adventure, Tawasul Insurance has the perfect travel insurance plan to meet your needs.